Introduction

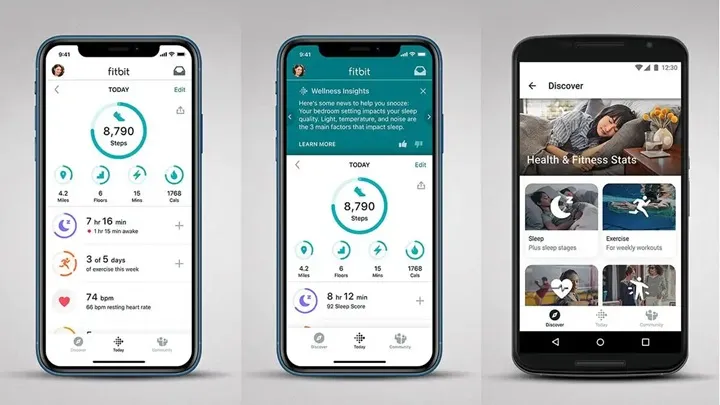

Managing personal finances in 2025 has become easier thanks to powerful mobile apps that help users track expenses, create budgets, and understand their spending habits. Instead of spreadsheets or manual notes, finance apps provide real-time insights and clear financial overviews.

Below are three of the most popular and effective personal finance apps helping users take control of their money.

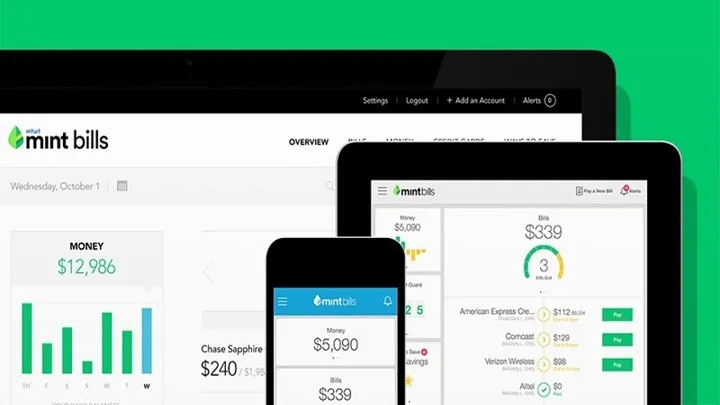

1. Mint – Track Spending and Build Better Budgets

Mint is one of the most widely used personal finance apps, offering a complete view of your financial life in one place.

Key features

- Automatic expense tracking

- Budget creation and alerts

- Bill reminders and payment tracking

- Visual spending reports

Why it works

Mint simplifies financial management by automatically organizing transactions and showing users exactly where their money goes.

Best for: Beginners who want an easy way to track spending.

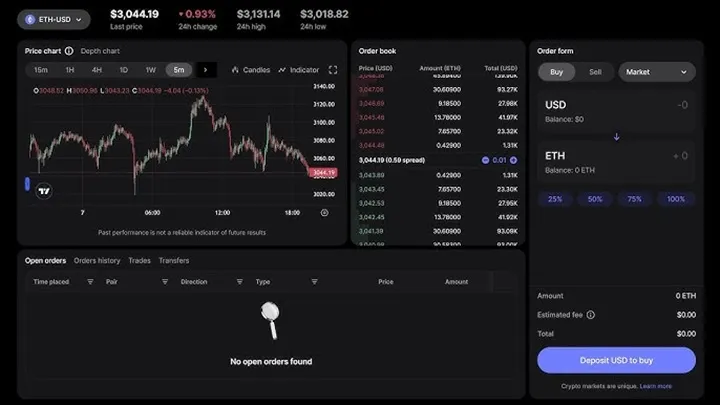

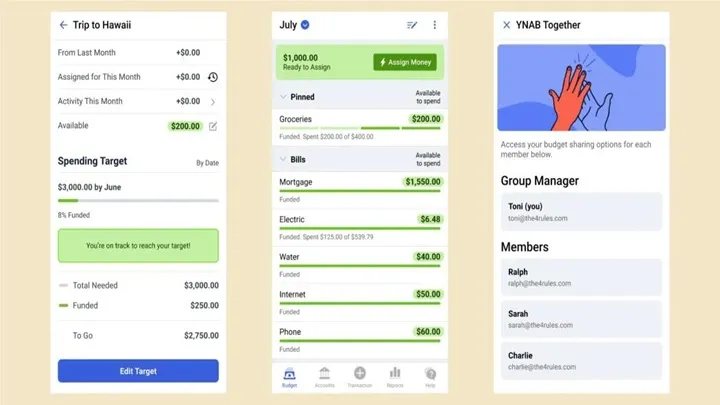

2. YNAB (You Need A Budget) – Plan Every Dollar with Purpose

YNAB focuses on proactive budgeting, helping users assign every dollar to a specific goal.

What makes YNAB effective

- Zero-based budgeting system

- Real-time budget adjustments

- Financial goal tracking

- Educational tools and tutorials

Why users love it

YNAB encourages long-term financial discipline and helps users break paycheck-to-paycheck cycles.

Best for: Users serious about budgeting and saving.

3. PayPal – Simple Payments and Money Management

PayPal is more than a payment app; it also helps users manage balances, track transactions, and send money globally.

Core benefits

- Fast and secure payments

- Easy money transfers

- Transaction history tracking

- Widely accepted worldwide

Why it stands out

PayPal offers convenience and security, making it a trusted tool for managing digital payments and online purchases.

Best for: Users who frequently shop or send money online.

Conclusion

These three personal finance apps — Mint, YNAB, and PayPal — provide essential tools for managing money smarter in 2025. From budgeting and expense tracking to secure payments, each app supports better financial decisions and long-term stability.